In the world of traditional B2B manufacturing, the promise of digital value creation has been a managerial focus for over a decade now. However, the journey and outcomes in these companies have been diverse and for many, somewhat a disappointment. In this article we argue that as digital becomes an increasing integral part of most B2B companies' core business, the operating model must be revised accordingly.

B2B companies should revise their operating model based on the following:

- As digital becomes an integral part of core business the operating model must be revised accordingly.

- When successful, the digital operating model impacts the business operating model, and lines between the two blur. For digitally mature companies, this distinction makes little sense.

- An organization reacts to change like an immune system to a virus. The operating model, if successful, can act as the vaccine.

We will dive into the evolution of digital transformation in B2B manufacturing through these 4 aspects:

- The evolution of B2B digitalization

- Lessons learned

- Archetypes of digital adoption

- Components of successful Operating Models

To gain a deeper understanding, let's begin by looking at the context of digitalization in B2B.

The B2B digitalization context

In B2B Manufacturing, digital transformation has been a complex journey. Unlike digital-native or SaaS companies where many best practices in digital transformation have come from, traditional B2B manufacturers face a unique legacy and operational focus. Their revenue depends on physical products, with extensive operations involving production, supply chains and warehouses. This influences the organizational structure, talent pool, cultures, and well-established processes. The saying “we've always done it like this” dictates decision-making and optics through deeply ingrained systems shaping the daily operations and workplace.

These systems encompass not only technological infrastructure but also the informal incentive structures that define company culture. Most manufacturers had an entrepreneurial culture at some point. But as they grew into global companies, quality assurance, compliance, scale and other demands forced them into specialization and little or no room for failure beyond the R&D department.

The influence of tech giants and the ‘Disruption Fad’

Tech giants like Apple, Amazon, and Silicon Valley innovators have redefined the conversation around digital. With their disruptive innovations they have not only reshaped their industries but also influenced how businesses perceive and pursue digital change. They challenged the status quo, emphasizing digital technology's potential to revolutionize business operations.

The term "digital disruption" transformed from a buzzword into a powerful force that reshaped industries, customer expectations, and business models. However, many B2B Manufacturers uncritically adopted this mindset, seeking new revenue streams without fully understanding the implications.

The pitfalls of uncritical adoption

In response to disruption, many B2B Manufacturers felt compelled to adapt and initiated digital pilots, innovation labs or programs on the side. These initiatives were often funded by marketing departments and operated separately from core business functions and strategy. To attract a new breed of talent and foster a more innovative culture, without the boundaries of ‘big corporate’, these locations were placed physically away from the HQ.

Adopting Silicon Valley's "move fast and break things" philosophy proved misaligned with the nature and operations of B2B Manufacturing, grounded in tangible products, complicated solutions and intricate supply chains. These efforts frequently failed to integrate with existing systems and lacked support from core business units, resulting in limited success.

Most of us who were there to experience it saw how these speedboat activities encountered the friction from core operations. The clash of systems, driven by a separation of focus between innovation labs and core business units, hindered progress and value creation. The failure to integrate these initiatives with core operations contributed to the lack of substantial ROI for most.

This discrepancy in approach and systems caused digital innovation to underperform its initial hype, with only specific industries and business areas experiencing true disruption.

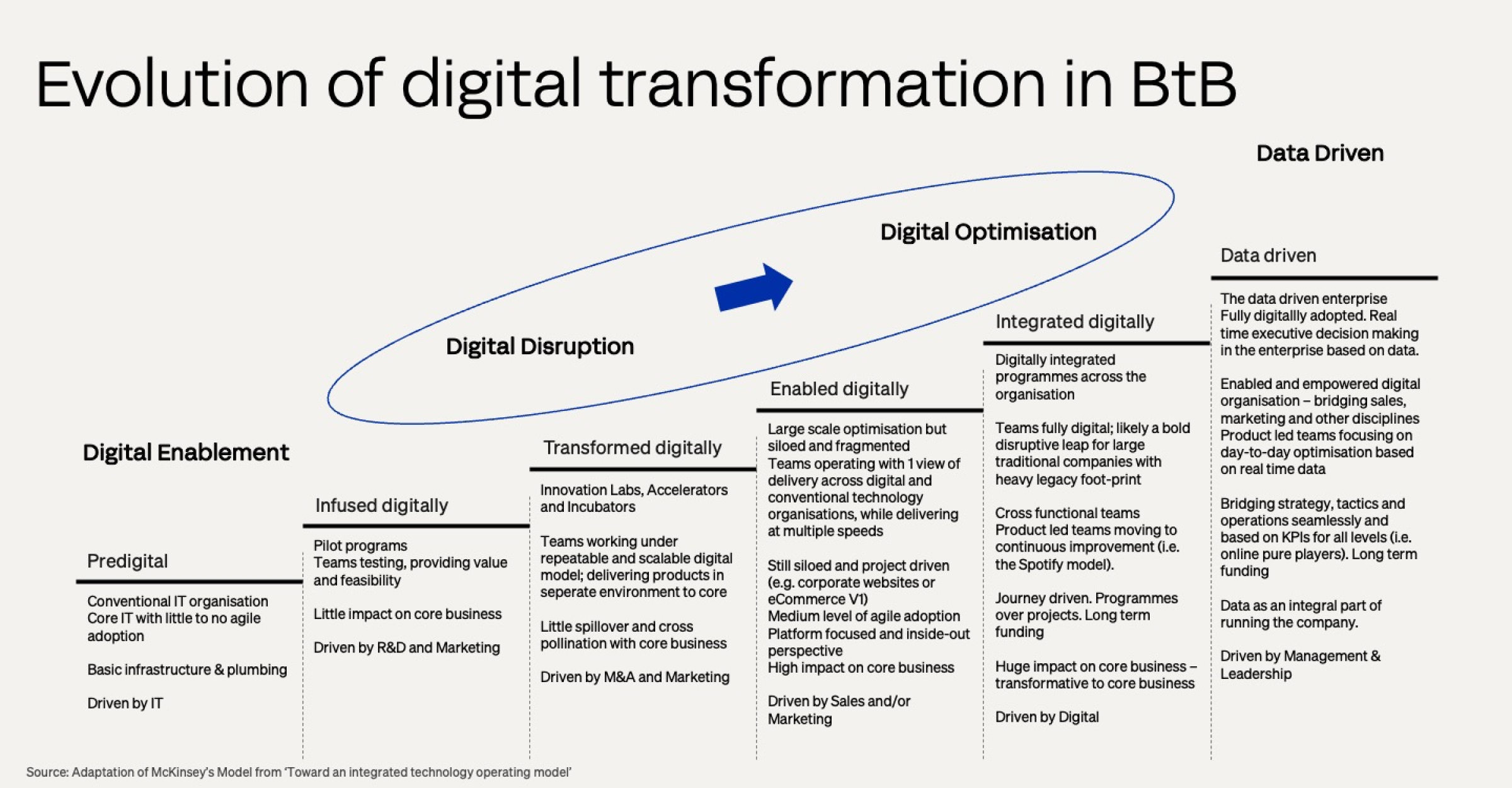

The shift in focus from digital disruption to digital optimization

In today's rapidly evolving digital landscape, the key to B2B success lies in a more pragmatic approach: prioritizing digital optimization over disruption. Digital leaders in B2B Manufacturing are transitioning from separate centres of innovation to cross-functional, organization-wide collaboration. Instead of high risk/high reward experiments, digital leaders are strengthening core offerings, developing assets for the balance sheet and differentiation around their core products.

This shift in focus represents the current era of B2B digitalization, with instant business value taking the driver's seat and digital initiatives and technology being enablers first and foremost. This pragmatic approach aligns digital initiatives with long-term success and sustainable growth, a departure from the earlier fixation on disruption largely driven by a fear of missing out.

The great digital divide – separating Digital Leaders from Digital Laggards in B2B-manufacturing

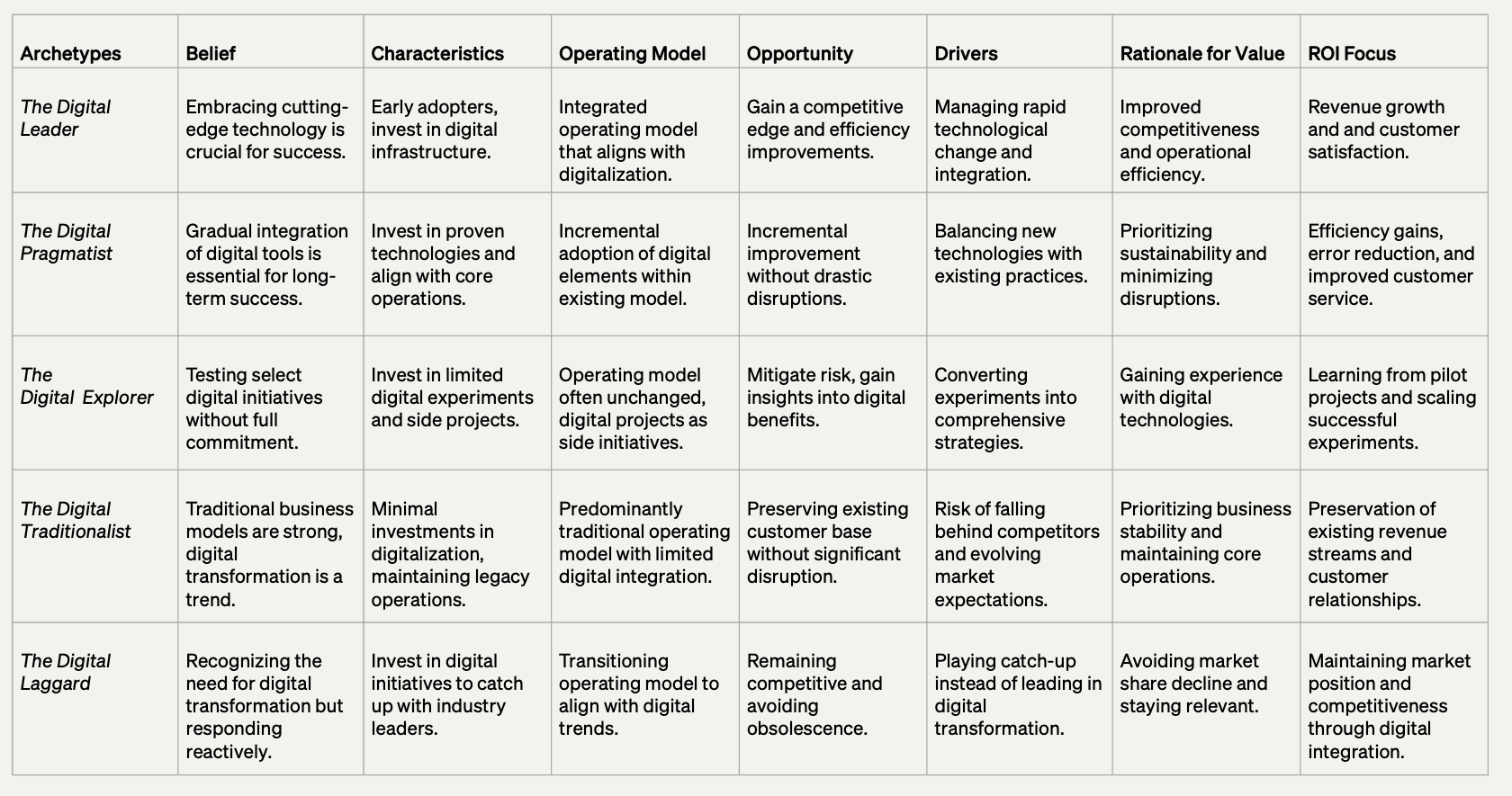

In our work we see a tendency towards a division – a polarization between B2B-companies when it comes to digital maturity and acceleration. We identified the following simplified archetypes and reasons for why they are either accelerating and succeeding or slowing down in their digital maturity. There is a clear correlation between the archetypes (table below) and the speed at which a company moves up the digital maturity ladder (illustration above).

We come across many companies that surprisingly encompass several of the archetypes depending on which part of the organisation we work with. However, thee most successful companies are unified around 1-2 archetypes and have a company wide recognition of the digital maturity and type of operating model.

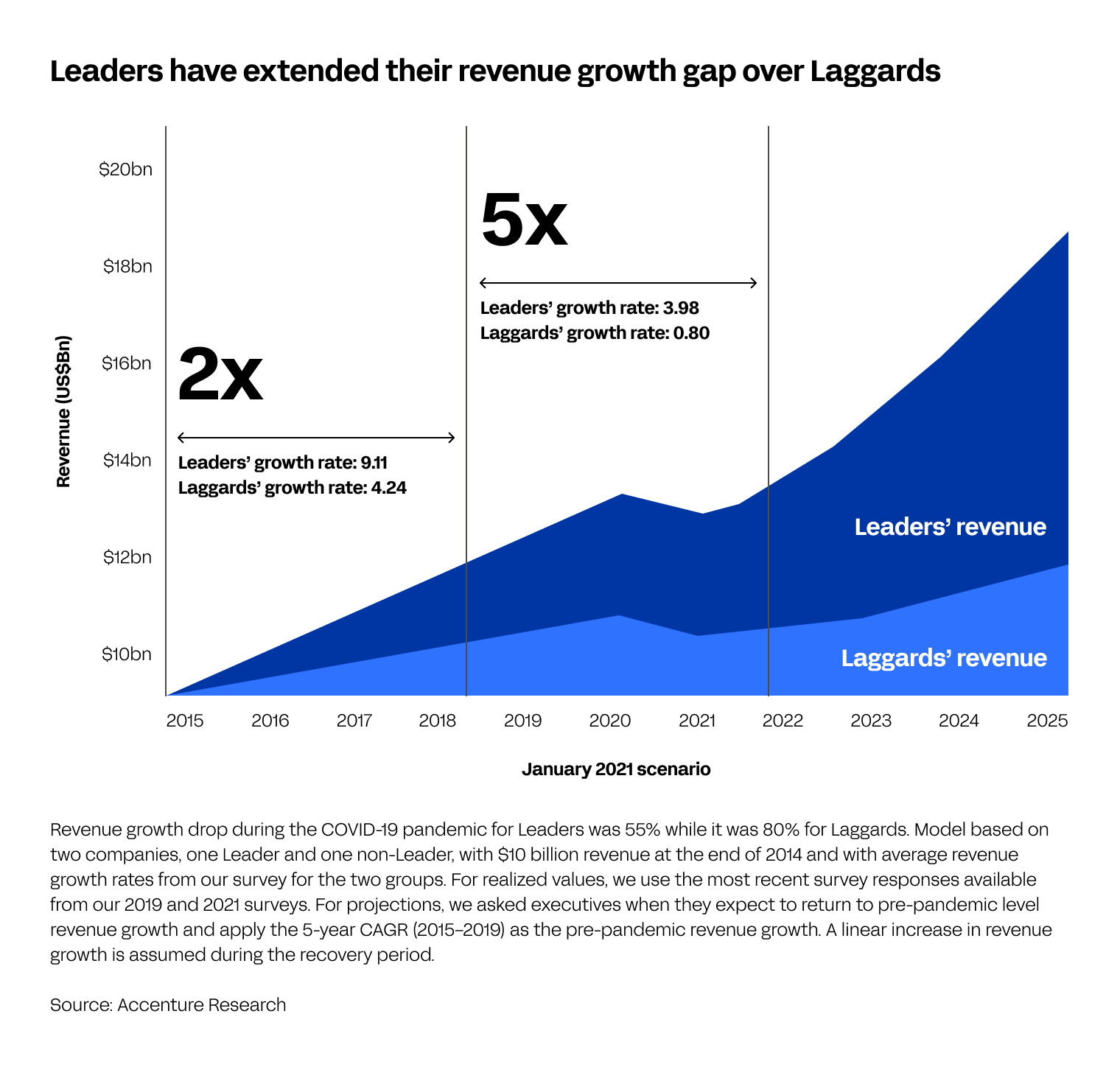

What is evident is that Leaders are pulling away from Laggards when it comes to growth. A study by Accenture showed that, with a growth rate 5x that of Laggards over, and with more optimistic expectations about returning sooner to pre-pandemic growth levels, Leaders are poised to pull away from the Laggards after the pandemic (see model below).

Across these archetypes digital leaders in B2B manufacturing typically take leaps and manage to bring their core operations to a new level. In a nutshell; They don’t get stuck in projects and politics. They apply digital to improve core operations and business. Digital leaders come in many shapes and sizes – but primarily they have a deliberate/conscious approach that has been examined as the approach fitting their situation, market, level of urgency and buy-in from investors/board.

In the digital age, investing in innovative technologies and initiatives has become the norm for businesses striving to stay competitive. However, the true measure of success in these investments often hinges on the strength of your digital operating model.

An effective digital operating model acts as the bridge between digital aspirations and tangible return on investment. To do so it is imperative that your digital operating model is integrated with core operations. If your eCommerce investments are linked to revenue generated only in that channel, why should your sales team push for adoption of the platform? Shared P&L across digital and non-digital channels are critical to avoid unhealthy incentive structures where everyone works for their own separate digital island.

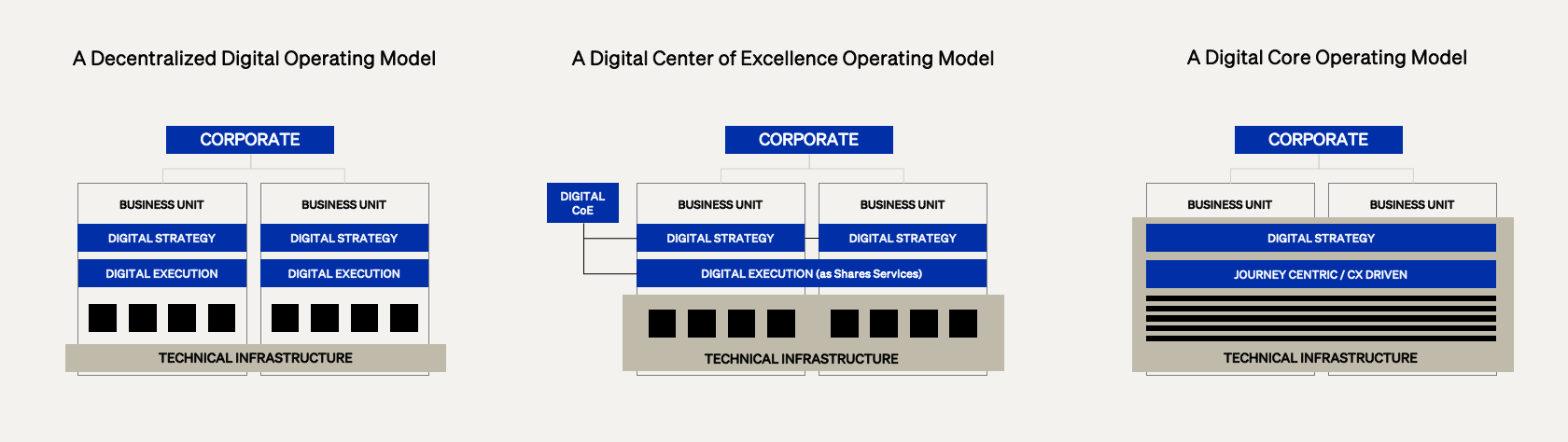

In the model below, we have outlined three common reference operating models. From left to right, we first have a Decentralized Operating Model, where digital initiatives are decentralized e.g., a market or a brand that has matured digital capabilities. The organization has been unable to get alignment and prioritizes funding and capabilities needed to work across the company. This is the least mature model and typically the approach of large incumbents. Some would argue it is an uncompetitive operating model in today’s world.

In the middle, we have a Center of Excellence Model, where a part of an organization has standardized best practices, design, knowledge, processes and sometimes technologies to ensure consistent, efficient, and ideally a high-value way of working. Global SMEs/experts curate either expertise or assets and work in partnership with different BUs to roll out those ideas or assets. Usually, this is the first step from having no digital practices to having some digital practices.

To the right, we have the Core Operating Model. This is a scaled agile way of organizing, where autonomous teams are delivering on a company-wide program that is highly customer- and journey-centric. Funding and accountability for delivering is tied into one place centrally. In this model, the markets/BUs or Brands will tap into that centralized capability to leverage the digital products. A digital Core Operating Model is a mature model, similar to that of native digital companies. Examples of Core Operating Models.

We argue that Digital Leaders that have leveraged true value creation in from moving Digital Disruption to Digital Optimization have been able to do so because of a change in their digital operating model. Variants of digital operating models come in all shapes and sizes; from internal startups and ventures, over project- and platform-based approaches, Bi-Modal IT and Holacrazy & Self-Management (think Spotify agile model). In larger B2B companies we currently see two prevailing variants of Core Operating Models;

- Scaled Agile Programs like LESS and SAFe where internal and external teams are organized around roles, processes, ceremonies, and artifacts to scale agile practices in large organizations. This provides a structured framework for how an organization operates at a larger scale, with the aim of achieving agility and alignment across multiple teams and departments.

- Product-led Agile Programs where internal and external teams, processes and culture are structured around a product-centric approach. Continuously improving and refining digital products which could be anything from the corporate website, over field-service apps to a customer portal is done based on an insights and hypothesis driven approach (i.e., real time product use, sales data and behavioral data) resulting in the launch of new or improved features aiming at improving the overall customer experience.

Regardless of the choice of operating model Digital Leaders are characterized by having leadership buy-in on board level and down, digital investments are consolidated into programs which allows for synergies, avoidance of redundancy, insourcing at scale, build-up of internal capabilities, overall cost reduction on certain areas i.e., less overhead compared to stop-start-finish projects. But most importantly - in both models above all digital efforts are consolidated with the aim of establishing a clearer connection to the overall value creation i.e., Portfolio and Program level in SAFe where commercial objectives are translated into the program backlog.

However, as an external implementation partner, we also see several downsides of large digital programs e.g., SAFe. One clear downside is the massive cost overhead of running a large program. A half day of PI planning (Program Increment) with +50 people comes with a high cost. It is also questionable whether these programs are actually more efficient than projects; are we actually delivering on the promise of agile and what is the alternative if not waterfall development? The two main drivers for the adoption of large-scale programs seems to be insourcing in recognition of digital becoming part of the core and the growing complexities and dependencies in the digital ecosystem that can no longer be managed from separate digital islands and projects.

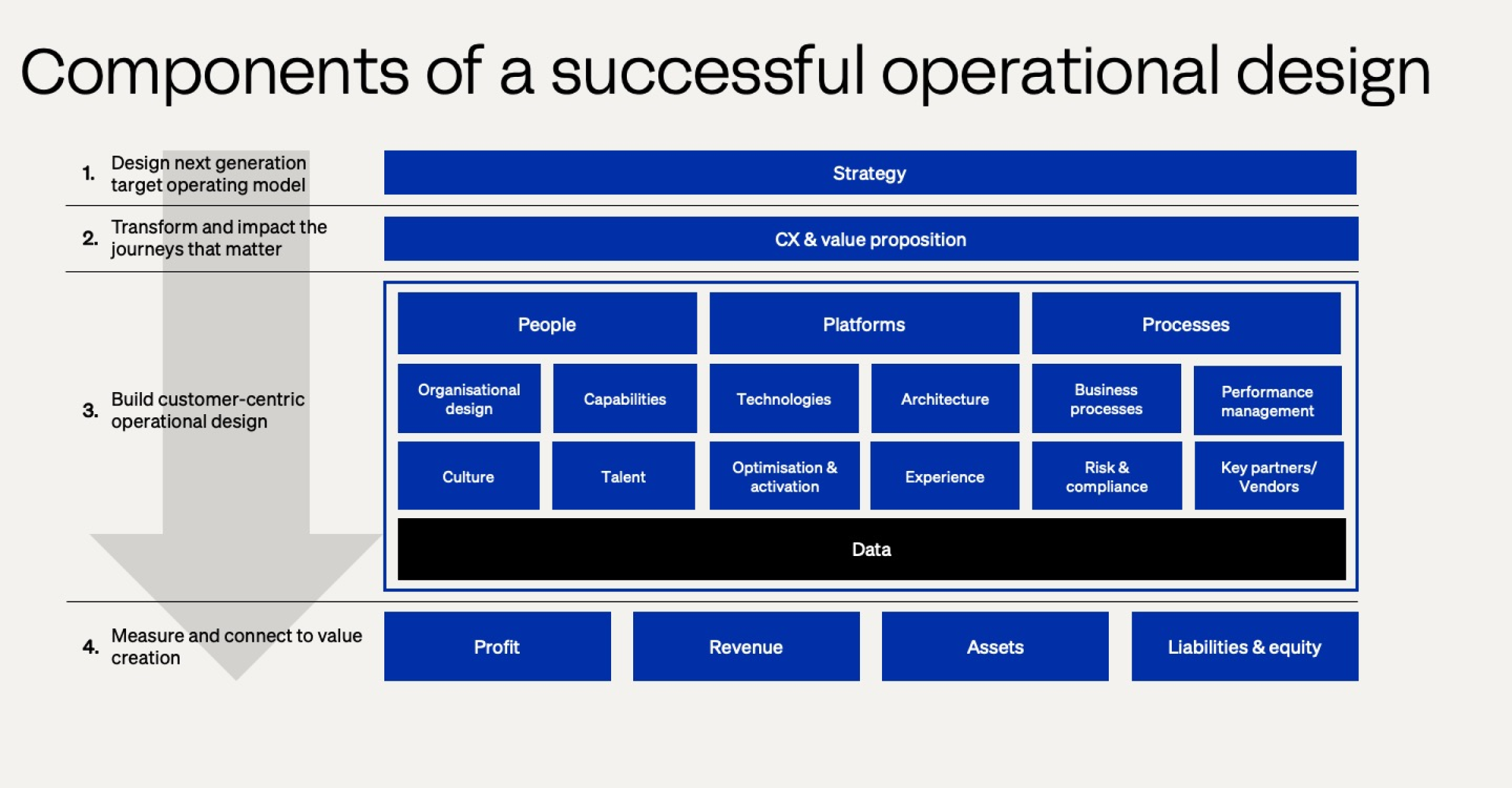

In the model below we have illustrated layers and components of a successful operating model. In this article we are not addressing the organizational perspective of operating models (although equally important). Levels 1-4 to the left make up the layers of a successful operating model.

4 Layers that are key to unlocking ROI

- Strategic alignment and leadership buy-in: Your leadership’s deep understanding of and commitment to digital integration is paramount. Digital initiatives must be an integral part of your corporate strategy.

- Rally the organisation around the customer journey: Be customer obsessed in all things – digital or non-digital – the customer experience should determine priorities. Putting the customer at the heart of you operating model helps break down internal barriers, misalignment between departments and removes ‘noise’ i.e. politics.

- Integration with Core Operations: A successful operating model consolidates all digital initiatives within your organization. It seamlessly integrates digital efforts with core business operations, ensuring that these two worlds complement each other.

- Value-Centric Approach: Your digital programs and projects must have a clear connection to value creation. This means bridging the “innovation gap” to your core business. The real success comes when digital services become assets with tangible value, ones you can capitalize on. They should not be perceived as sunk costs but as assets, much like a building or a machine. It is not just about proof of concept; it is about industrialization and operationalization.

What we have seen with our clients in the recent years is that digitally mature companies have focused on level 1,2 and 3, Meaning that their digital program have been grounded in a Corporate Strategy (level 1), maybe even have designed a product led organization focused on the customer journeys (level 2) and perhaps also establish well-defined capabilities (level 3). However almost all companies are struggling to connect their digital investments with real value creation and in a measurable way that allows for ongoing optimization and improvement based on real time business critical data (level 4).

As Digital is becoming increasingly integrated with core operations, company leadership is demanding a higher level of transparency when it comes to value creation. For senior leaders with Digital P&L connecting level 1-3 with level 4, a clear and measurable value creation should be a key priority. Sure, business cases are made to connect investments with value creation. But business cases are largely based on promises, assumptions, and expectations. We predict that, as companies move towards Digital Optimization and establish operating models where digital is an integral part of core operations, new levels of transparency for value creation are needed. Inspiration could be sought from online eCommerce pure players where business decisions and product improvements are made based on real time data i.e., sales data and behavioral data.

In Conclusion: accelerating digitalization through value from the core

In today's rapidly evolving digital landscape, the key to B2B success lies in a more pragmatic approach: prioritizing digital optimization over disruption (or rather being very deliberate of when you work with one or the other). Another way of phrasing it is digital enablement (optimization) over digital innovation (disruption).

We have seen significant shifts in the evolution of digital transformation within B2B manufacturing. Disruption as a theme has come and gone and B2B companies have reduced most digital side projects. The digital projects and products that are successful are part of optimizing core operations e.g. eCommerce. In this article we have argued that digital transformation needs to happen close to the core of the business. To do so the operating model becomes essential.

Your operating model defines how your business operates, from its strategies and processes to its culture and organizational structure. When it comes to digital investments, it is the linchpin that determines whether these initiatives are destined for success or failure.

Your operating model should be the blueprint through which your digital investments translate into measurable value, steering you away from isolated digital projects and towards a cohesive, profit-driven digital strategy that generates real assets for the company’s balance sheet.

In this article we have argued that as digital becomes an increasing integral part of most B2B companies' core business, the operating model must be revised accordingly. Establishing the right operating model, with the digital experience as an integral part rather than a foreign element, may be the critical factor that distinguishes digital leaders from the digital laggards.