Fractional Ownership

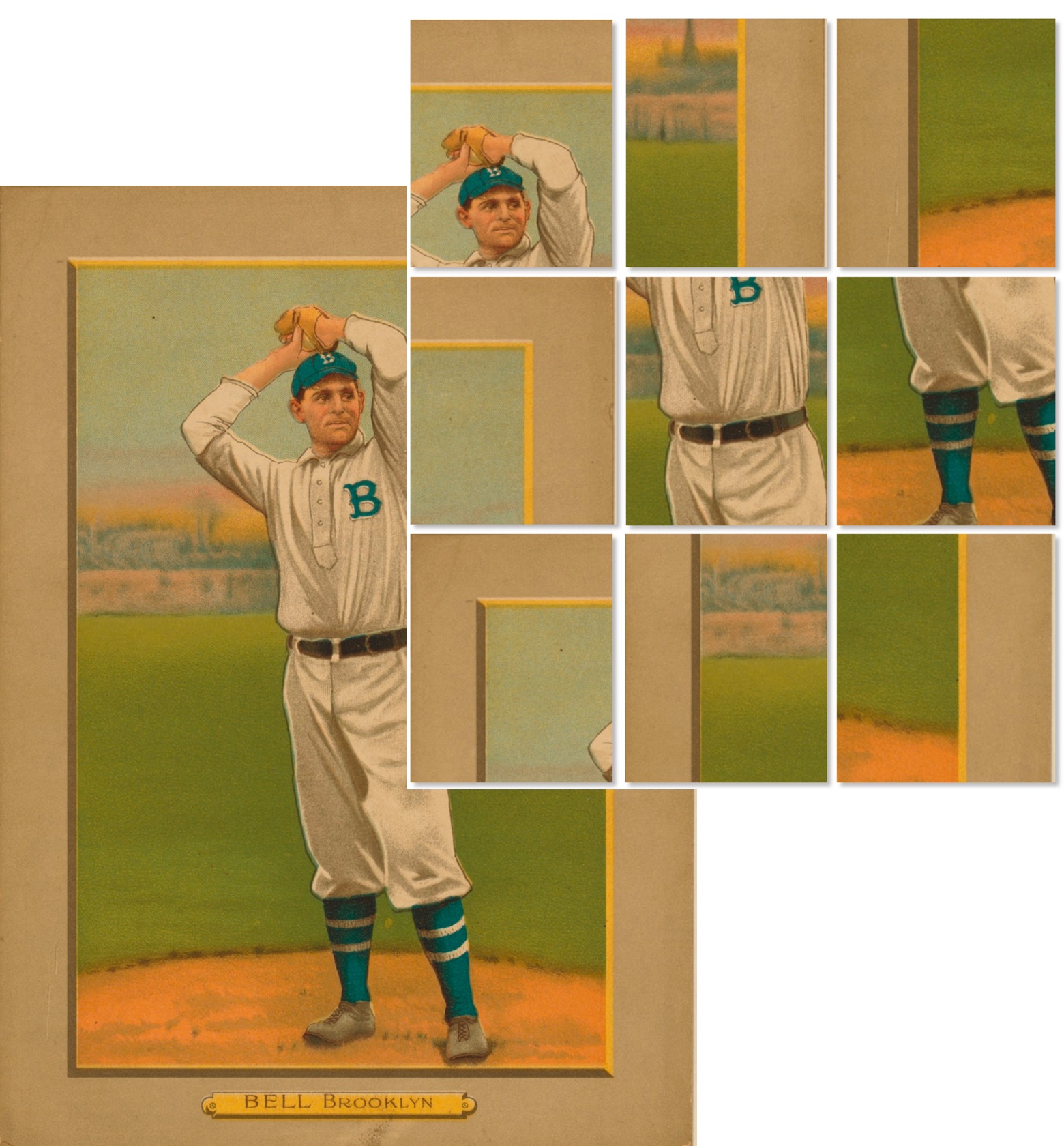

While browsing your feeds and listening to people talk, you might be led to believe there is a clear delineation between NFTs and “regular” fungible tokens. NFTs are unique and not interchangeable while others are the opposite and work, for example, like currency or loyalty points. While that remains true, we can still blur the line a bit and get interesting results. It is called fractional ownership, or shards of an NFT.

The idea is simple – Create a fungible token, with a non-fungible token as an underlying asset. Example: Issue 10,000 tokens (“shares”) by splitting the ownership of an NFT in tradable fungible (ERC20 style) tokens. This makes NFT ownership fractional and tradable, whilst owned by a community according to their invested shares. The NFT can represent anything and everything, like an upcoming album with promise of kickback on the revenue (crowd funding), unlockable content or limited editions (sales of collectibles).

Issuing the fungible tokens on top of the NFT lets us treat NFT ownership much like stock in a company. Companies are unique, like NFTs, and shares are both tradeable and interchangeable tokens of ownership. A couple of years ago, this was broadly the mechanism enabling the Initial Coin Offering (ICO) hype. Using NFTs as the token asset opens new possibilities, beyond ICOs.

Implementing Fractional Ownership

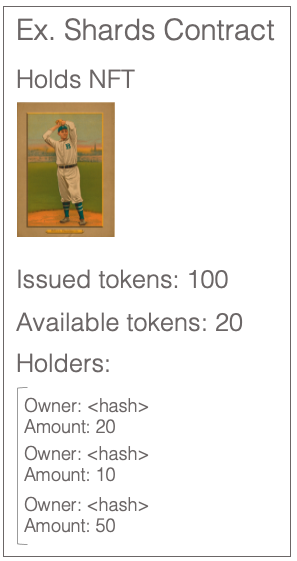

In order to make fractional ownership reality, one needs to put a few fundamentals in place to manage the NFT and issuing tokens. In addition, business logic for the contract specifics may be added.

On Ethereum, ERC20 is the name of the common standard for fungible tokens. It enables issuance of tradeable fungible tokens. If the ERC20 token supply is set to 1, the token can be viewed as an NFT, which closes the circle (note: ERC721 and ERC1155 are better NFT choices). In the end, there is no fundamental difference between fungible and non-fungible tokens from a smart contract perspective. It is just a question of supply, metadata and contract API.

A smart contract for fractional ownership must include a trusted store, like a vault, where the underlying asset will be held and provide methods to manage it. For example, it must not be possible to remove the underlying asset, unless the contract is liquidized.

In addition to that, the contract must be able to issue ERC20 tokens to sell fractional ownership in the underlying asset. Issuance of tokens is a standard process, which is well published in depth on various posts and tutorials around the web.

Having those two pieces in place, concludes all the must-haves for fractional ownership. It allows the creation of custom tokens based on NFTs that users can buy and sell to each other as regular ERC20 tokens. After the basics, it is only a question about adding specific business logic.

Adding Flavor

These are some ideas of additional capabilities to consider for a fractional ownership contract.

A DAO- For a fully decentralized approach, the contract could be setup like a Distributed Autonomous Organization (DAO), where the holders of tokens also govern the contract. It could, for example, enable voting according to percentage of ownership and approving sales for the NFT to liquidize the token.

Managing Royalty– It is not uncommon for NFTs to payout royalties to the owner or creator, when the NFT is sold on, or some other condition is met. A successful contract should include functionality to distribute kickbacks among token holders when kickbacks are transferred to the NFT-holding contract.

Bundling/Merging– While we are at it, it could be interesting to consider adding some ability to merge contracts into funds where one contract buys or merges with another or adding additional NFTs to the underlying collection. A scenario could be that the NFT generates income, and the income is held in the contract instead of being distributed. Those funds could be used to buy additional NFTs held in the vault.

In Summary

Although the NFT market has crashed, it is still interesting to consider the new possibilities through NFTs and smart contracts. Fractional Ownership is a natural extension to NFTs and opens the possibility to hold and trade shares of non-fungible tokens in the form of fungible tokens.