For former generations, there has been a status based on the products you own – the handbag, the coat, the watch… today it is all about how consumers experience the brand both in physical and digital worlds.

七月 19, 2022

Today, the ability to affect luxury sales performance has never been so multifaceted. Whilst the pandemic certainly played a role in the rapid step change that we are seeing in the industry, it is far from the only influencer. More so is the remarkably interesting shift in the luxury consumer and audience. Younger, channel agnostic, and more interested in digital experiences than physical products.

For former generations, there has been a status based on the products you own – the handbag, the coat, the watch… today it is all about how consumers experience the brand both in physical and digital worlds.

我相信,奢侈品行业具有迎接数字化转变的能力。

Ilaria Aprile

Valtech全球奢侈品客户主管

Successful digital transformation not only aims to improve operational agility and channel performance, but to elevate the customer experience and meet the expectations of customers. That has always been the main driver of any successful luxury brand, and no matter how complex the challenges might be, brands must invest to succeed.The opportunity is in how they respond to their new customer profile and how they continue to drive innovation to elevate the brand experience.

I.A: For the entire luxury industry, Covid-19 has been a driver for change, forcing brands to accelerate digital transformation, and propelling them towards a digital-first, customer-centric modus operandi. Highlighting the need to modify organisational structures and implement new technologies.

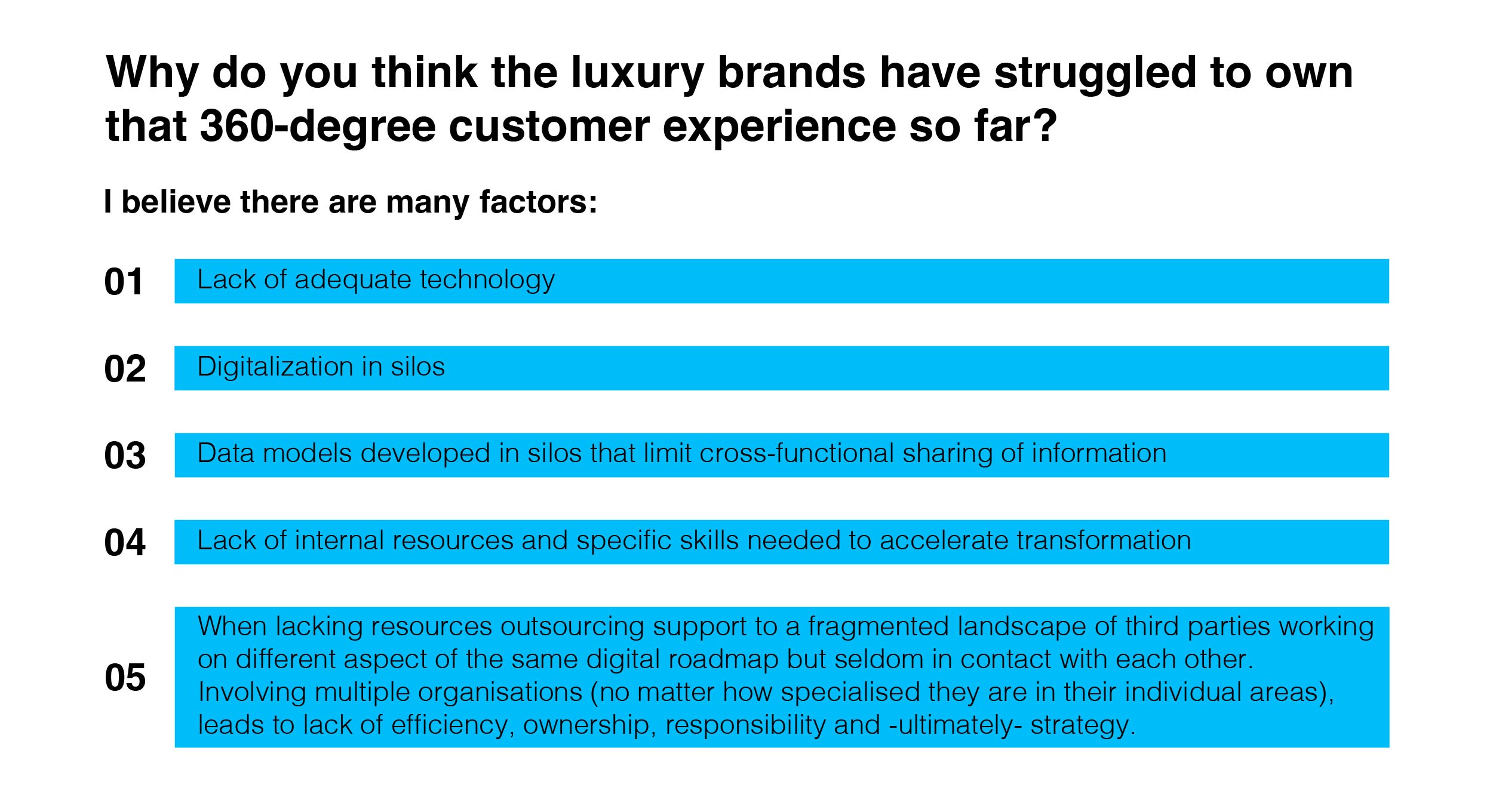

We saw consumers demanding greater adaptability, responsiveness, and customization from brands, but many retailers lacked the tech and data foundation to meet these expectations. Some were really far behind the digital curve, and the rush to innovate clashed with their aging infrastructure, disconnected customer services and siloed data information. The pandemic exposed the lack of required skills to support these transformational challenges within the existing organization.

Brands learned the hard way that any digital transformation work had to be significantly accelerated and technology investments had to become the driver of next-generation retail and D2C e-commerce growth.

Today, consumers want to interact with brands across multiple touchpoints. Going forward, these retailers will need to be able to build the right ecosystem to be able to meet the client at the right moment at the right place to remain competitive.

The brands that build a solid tech foundation, paired with a robust data architecture and AI strategy will be able to impact performance and support the seamless integration of online and offline channels. Making the most of the smart digital services that will support the end-to-end customer decision journey.

Some might also consider the more modern and composable digital experience platforms, based on MACH (Microservices, API first, Cloud native and Headless) technologies, which are born to support exactly these kinds of complex ecosystems.

To learn more about MACH, listen to our podcast.

Q. What are the must haves for luxury brands to remain competitive in this new context?

I.A: Hyper-personalization is the new MUST! Younger, digitally native, channel agnostic customers have raised the bar when it comes to their expectations for shopping. They expect to be able to buy anywhere (physical and digital products, in store, online or via livestreaming), ship anywhere, pick up anywhere.

They also expect brands to provide them with product choices and experiences that are tailored to their individual preferences. Think digitally curated shopping experiences and events including Zoom consultations, concierge services, personalized payment links and more.

Brands have a big challenge ahead to be able to consistently address these expectations across channels. But the rise of AI and Machine learning in recent years has made things easier and brands that invest in enhancing their online and offline offering by leveraging these tools will be able to provide customers with the level of expected personalization across multiple channels.

I.A: D2C: Traditionally heavily reliant on wholesalers such as Net-a-Porter or Matches Fashion, the business model for selling luxury and fashion online has experienced a rapid transformation in the last few years. It highlighted the importance of keeping a direct relationship with customers across channels. Improving ecommerce D2C performance has increasingly become a key priority for executives across brands.

Today, only a few can count their own e-commerce sales to be above 10% of their global revenues.

The opportunity for growth is significant but competing on the same battleground with pure players means matching their high standards on experience and service levels. They need to solidify their e-commerce platforms, operational capabilities and grow their dedicated teams to be able to expand and localize e-commerce operations across multiple geographies to meet the needs of specific markets. Read more about e-commerce strategies in this blog.

The role of the store is evolving into an adaptive and interactive virtual environment that encourages long-term engagement and loyalty, and presents customers with entirely new ways of engaging with products and services. Brands are embedding digital to enhance the physical shopping experience across operations (click and collect, RFID, mobile applications, fulfilment automation) and alongside the customer journey (digital mirrors, flowless checkout on iPad, interactive products and boutiques windows).

Recently we've seen the store become “mobile” so that the customer can experience the best shopping experience a brand can offer directly at their home or when on vacation, powered by digital personalization. The London-based start-up Toshi has been offering this service for LVMH.

I doubt we will ever see a complete pivot to online buying for luxury customers, the store will always remain an important experiential touchpoint, but clients will expect a more intuitive in-store experience from retailers.

To support brands in integrating these innovations across the luxury value chain we have seen the rise of an ecosystem of dynamic start-ups ready to answer every consumer need, and bringing fresh ideas to industry players.

From livestreaming solutions and advanced clienteling tools, to virtual try-ons, digital sizing solutions and interactive chatbots the list is long. The quest for customer service excellence is ongoing and constantly evolving and I personally find this tremendously exciting!

To learn more about retail innovation and technology, discover what our creative technologists are up to.

I.A: Web3 is shaping a new economy providing the opportunity to build an additional source of revenue for luxury companies.

To reach untapped audiences and recruit new generations of customers, luxury brands are racing to meet them in their native environment, the Metaverse.

The Metaverse represents a new interaction point, requiring fashion brands to adapt both their tone of voice to the conversation within the space, and to find new ways to monetize these virtual worlds by adapting traditional revenue drivers and strategies.

Even if a fully formed metaverse (a massively scaled and interoperable network of real time rendered worlds which can be experienced synchronously by an unlimited number of users with an individual sense of presence) — doesn’t yet exist given technology constraints, luxury players are gearing up to develop communities in the space that will help build trust and drive their revenues in the future.

Understanding today’s early adopters will help brands predict and profile tomorrow’s virtual-goods buyers.

In the last 12 months we have seen major luxury players building experiences across different Metaverse platforms following a trial-and-error approach. Brands that I see being successful in this environment are the ones that will learn to adapt and build the future of the brand experience and products in the space, together with newly created communities.

I believe the next step will be for industry leaders to move from one-off initiatives and marketing stunts to focus on how to make the space a sustainable source of revenue. Imagine if brands were able to launch digital collections virtually 5 or 6 times per year - as they do in the real world - across different platforms.

Meanwhile, the most forward-thinking brands are focusing on creating demand. Gucci created a bespoke collection aimed only to dress the Bored Apes Yacht Club PfPs. That is a good example of a brand successfully building demand in the space by dressing the resident celebrities as it would in the real world. But there is still a gap between people experiencing the Metaverse vs people buying in the metaverse.

A recent study conducted by Valtech future studio highlighted how only 10% of people visiting a Metaverse worlds have actually purchased something.

Nevertheless, the Metaverse has already impacted fashion companies across the full the fashion cycle (digital twins, virtual try-ons, holograms, 3D modelling production, virtual body scan fitting and more...) and it will also reshape the landscape of retail. From physical shopping experiences, to dramatically changing the way we connect and experience the store, it is blurring the lines between content and product.

I believe that traditional Omnichannel services will evolve into fully immersive shopping experiences. Digital and physical worlds will ineluctably interconnect, and brands will need to ensure a seamless transition between both worlds.

Full adoption will come in a few years and the pace of it will be determined by technological advancement, the interoperability between virtual environments and social acceptance.

Depending on their long-term vision and revenue goals, brands will need to decide the level of investment they are willing to make, to develop and integrate the technologies that will enable them to grow and support this customer evolution.

The success metric for these companies will be in finding a way to own that end-to-end experience. From strategy to technology to organisational change… each of the elements will need to work in concert to make a lasting business impact.

We hope that you found this article valuable, and that it sparked the inspiration to review some of your own activities. With more than 15 years of experience delivering on and offline strategies for the luxury industry across Asia and Europe with companies including the Net a Porter/Alibaba joint venture, Christian Dior and La Perla, Ilaria works alongside our luxury client portfolio to support their digital transformations. If you want to continue the conversation, please reach out to her.