Important trends in banking

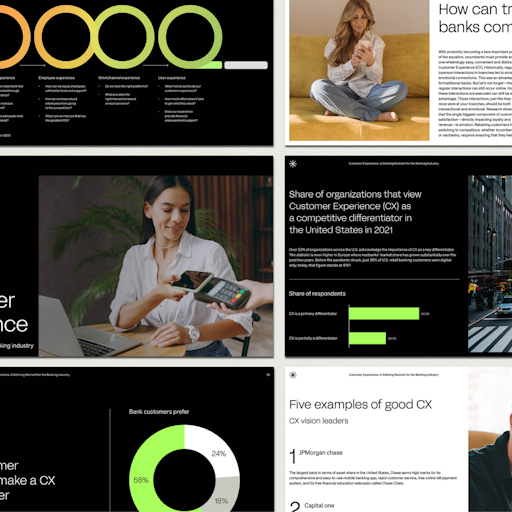

The trends in banking contributing to the changes in CX are varied and include actions on behalf of banking customers as well as general changes to the digital and industry landscapes that are forcing changes to come more quickly than anticipated. Some of the banking trends explored in this whitepaper include:

- The emergence and dominance of Neo Banks

- Steady growth of mobile usage and preference in banking among customers

- Customer expectations on personalization

Improving the customer experience in banking

In this whitepaper, you’ll find tips on improving the CX at your bank, information about how to form a successful CX strategy for finance customers, and in-depth information about the CX strategies that are working for the institutions that have decided to focus more on CX. Whether you’re looking to update an existing CX strategy or create a new plan from scratch, the tools for success are in these pages.

Additionally, understanding the technology that exists today to help accomplish CX goals and create never before seen customer experiences is also important. We go into detail about the tools that exist, the technology others might not think of including in their CX strategy, and much more. Download the paper today to explore the topic of next-gen CX options for Banking customers.