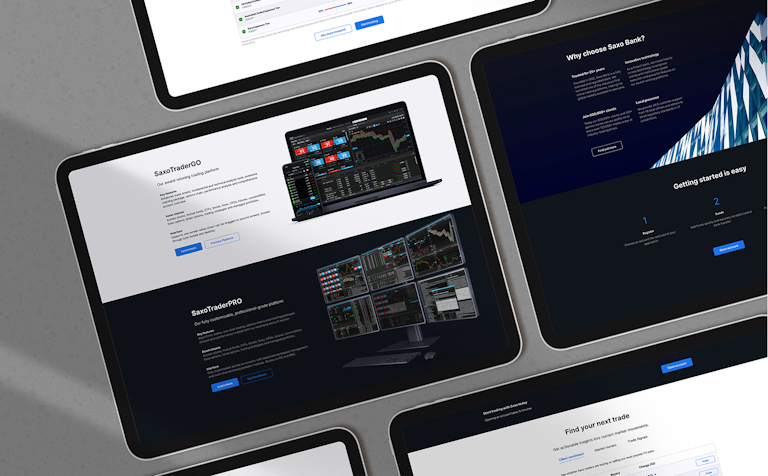

Saxo Bank is a Danish investment bank specializing in online trading and investment. It was founded as a brokerage firm in 1992.

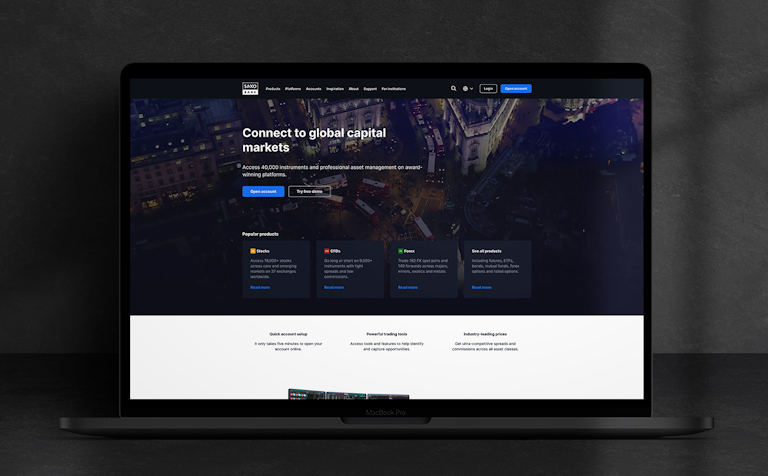

Saxo Bank supports more than 600,000 clients throughout the world, helping them to make more than 125,000 trades each day. When they needed a new website, they turned to Valtech for help.