The innate filthiness of cash is common knowledge. But when people talk about shifting to a cashless society, they don’t simply mean using credit cards to make all of their purchases. Cashless in the post-Coronavirus world will include more contactless payment options. But with an astounding 55% of companies still relying exclusively on cash, how can we transition to the future we need?

The following are a few easy steps brands can take to start the transition. In the end, a joint venture between brands and financial institutions (banks, credit companies, etc.) will be needed to make the change work, but that doesn’t mean we can’t start moving in the right direction now.

The Benefits of Going Cashless

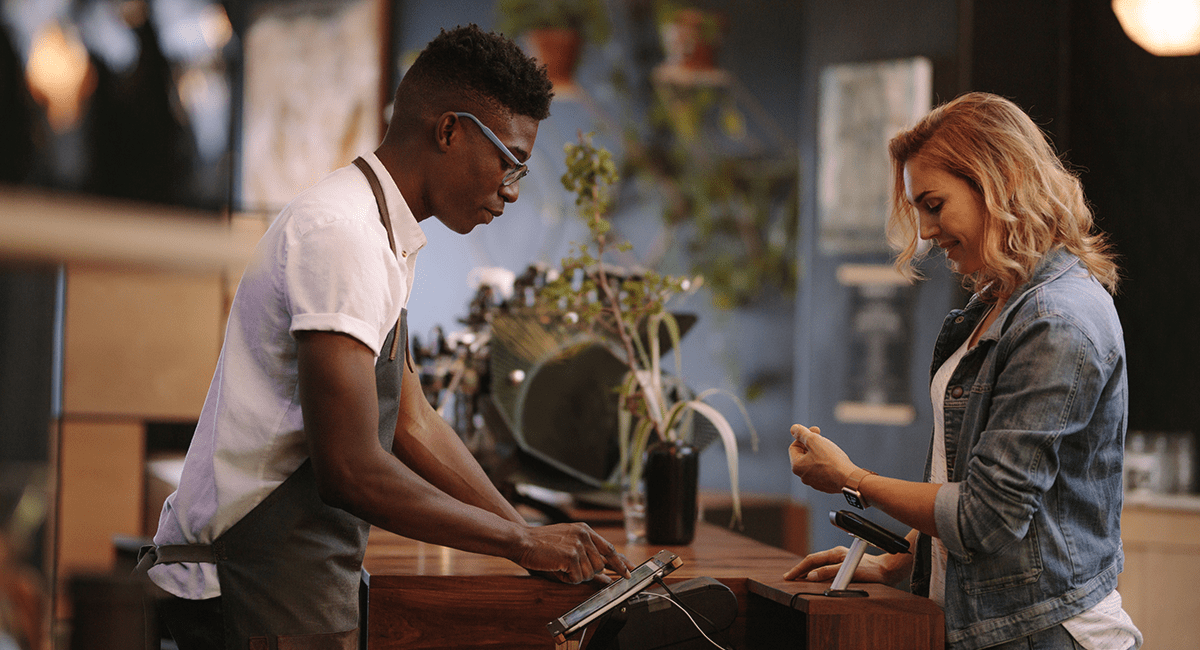

In the current moment, it’s easy to see the benefits of cashless, contactless payments being offered at points of sale across the world. People aren’t going to want to touch screens and POS machines for the foreseeable future. But the benefits of phasing cash out of our regular transactions go deeper than increased hygiene.

Cashless transactions are all about convenience. Accidently left your wallet at home? You can buy that latte with your smartwatch or phone, no cash or credit card required. The convenience factor is heightened when you start looking at payment platforms across physical and digital environments. A customer can pay with their phone at your store, and checkout online with a single click using platforms built by Apple and Google. We are implementing platforms like these for clients across the entire customer journey—in and out of stores, online, on mobile apps and through loyalty programs.

A cashless system could also be the first step towards implementing a universally accepted payment system. Currently, people travelling between nations are often required to exchange cash at the current exchange rate. Having cash on hand is important when traveling due not to the number of cash-only businesses you’re likely to encounter, but because even businesses that offer other payment options might not accept a traveller’s particular debit or credit card. However, if mobile wallet apps were more universally accepted methods of payment, we could eliminate this need.

A cashless system could also be the first step towards implementing a universally accepted payment system. Currently, people travelling between nations are often required to exchange cash at the current exchange rate. Having cash on hand is important when traveling due not to the number of cash-only businesses you’re likely to encounter, but because even businesses that offer other payment options might not accept a traveller’s particular debit or credit card. However, if mobile wallet apps were more universally accepted methods of payment, we could eliminate this need.

Exchange rates change quickly and with more frequency than most people pay attention to. These changes tend not to affect anything in our daily lives, but these rates dictate how much the U.S. Dollar is worth in other countries. Because these changes are recorded and updated in real time, sharing that information with wallet apps used for mobile payments and using that information to determine how much money is being deducted from a customer’s account and placed into the merchant’s account could all be seen in real time in the app. Thus simplifying a number of different transactions for people on vacation or travelling for business.

Barriers to Going Cashless

There are a lot of different requirements for making this massive shift. Some of them are big issues with financial services and companies needing to make advances in the way they accept and process payments and money transfers. Others, however, can be enacted directly by brands at the POS.

For starters, brands should get a head start by making sure all POS devices are RFID or NFC compatible and ready to receive payment through the most common contactless payment options. In the short-term, the benefits of accepting more payment options instead of fewer is obvious, but in the long-term, having this functionality available now means that you’ll be well prepared ahead of any official push towards making your country cashless.

For certain brands, transitioning to accepting these forms of payment invites competition for their unique credit cards and loyalty program offerings. In the end, brands have to ask themselves whether adoption of their personal credit card is more important than increasing transaction volume, because if big brands choose to ignore the changing landscape in favour of supporting their own payment and loyalty offerings, they can be sure to lose customers to competitors putting the power of multiple payment options into the hands of the consumer.

For certain brands, transitioning to accepting these forms of payment invites competition for their unique credit cards and loyalty program offerings. In the end, brands have to ask themselves whether adoption of their personal credit card is more important than increasing transaction volume, because if big brands choose to ignore the changing landscape in favour of supporting their own payment and loyalty offerings, they can be sure to lose customers to competitors putting the power of multiple payment options into the hands of the consumer.

Instead of running away from the contactless payment options of the future, brands with their own credit lines and specific loyalty programs should work to lead the charge in contactless payments and should look to pair their loyalty programs with certain incentives for making the switch to contactless payments. It would be wise to reach out to players like Apple, Google and Alipay to ensure that a brand’s card offerings can be easily included in those platforms’ digital wallet ecosystems.

Being forward-thinking has always been crucial in business, but possibly never more so than at the current moment. Our world is changing so quickly that keeping up means thinking ahead. The e-commerce boom rocked the retail world once before and threatened a number of strong, long-standing brands. The contactless and cashless payment revolution is right around the corner. Its arrival is being accelerated by COVID-19. No one could have predicted that e-commerce would take the world by storm the way it did, but we have a clear warning about the next big change. Now is the time to get ready to meet it.