There is a great research study on customer expectations in retail that was conducted by PWC in 2016. We have used some of their findings as we’ve gathered our own conclusions around the digital implementations of the data.

Price

Today’s consumers have more pricing information at their fingertips than ever before. The ability to check competing prices online, on phones, and in the store establishes firm expectations for retailers to be able to price match, and beat, the costs that are found on these different platforms. A good way to mitigate the constant demands to match and lower prices is to offer a level of service that customers can’t get elsewhere. This can include supplying exclusive goods, extraordinary satisfaction guarantees, and friction-free return policies. If price matching is still the only option, it is important to balance these losses with products that generate enough profit to cover them.

Stock

Customers expect items to be well stocked in the store. Largely, modern inventory systems and streamlined logistics are able to control and fix stock issues when they arise. If you’re a retailer with legacy systems that don’t fix supply issues, you need to replace them because you’re at a serious competitive disadvantage. However, if you have modern systems, and outliers occur that cause stock to run out, customers’ frustrations can be calmed if they are offered the option of ordering out-of-stock items via their phone or other in-store digital methods. When these alternative options are coupled with the guarantee of fast shipping, the customer’s goodwill towards the retailer can be maintained and the problem of these outliers is greatly diminished.

Omni-Channel

We’ve covered the immense benefits of omni-channel in previous articles, but it is worth mentioning again in this context. Consistency between channels is the key to the customer journey. Single-Sign-On is paramount to this effort – customers do not want to have to keep track of different logins for different platforms within the same store (website, app, loyalty programs etc.). The single-sign-on model can be elevated in the in-store implementation. Technology allows for cross-pollination between customers online actions and their brick and mortar experiences. If physical stores are aware of the statuses of their customers’ online shopping carts, they have the ability to physically guide customers to their unpurchased items in the store using their phones. Tying these experiences together seamlessly defies customers base expectations while vastly increasing sales across multiple platforms.

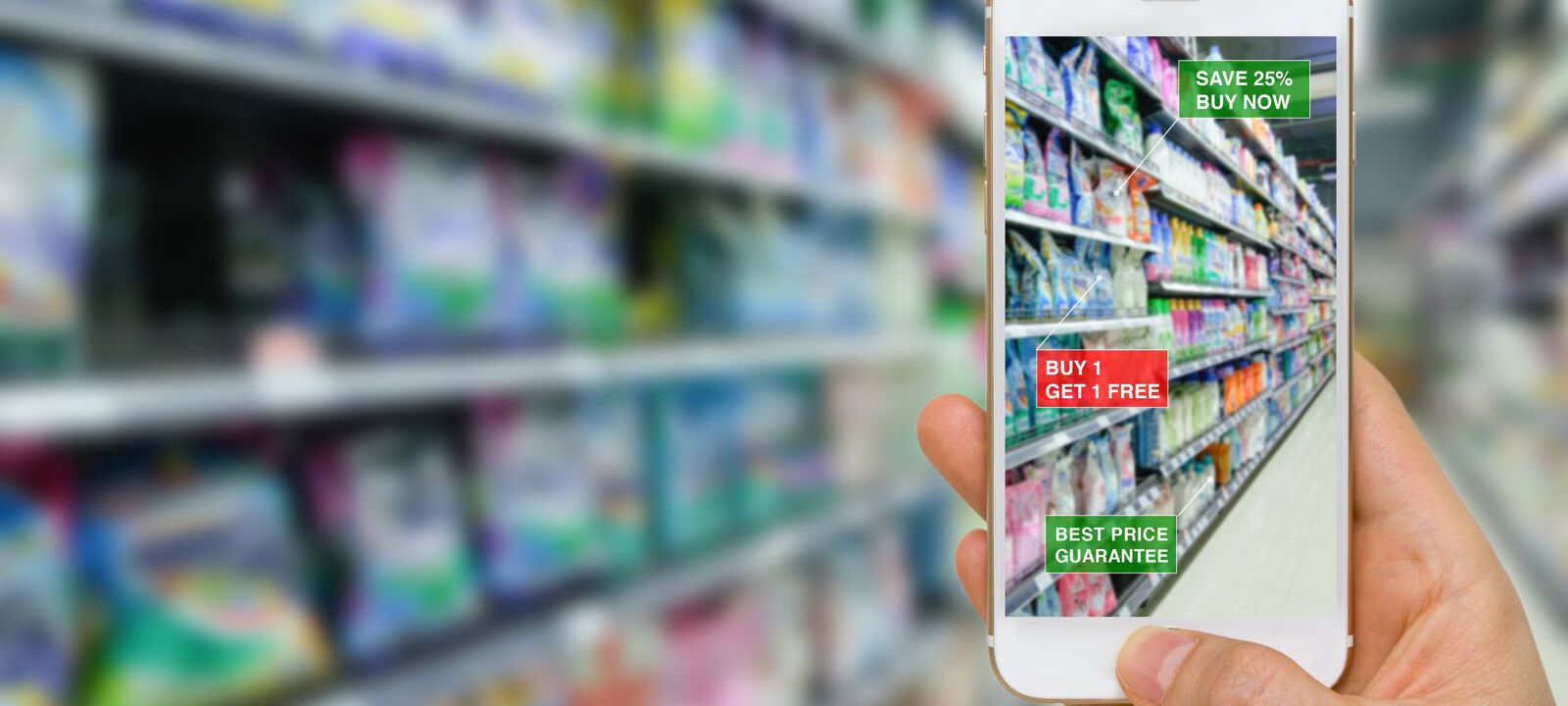

Mobile Commerce

The online shopping tool of choice is rapidly transitioning from desktop to mobile devices. According to Business Insider, mobile commerce will reach $284 billion, or 45% of the total U.S. e-commerce market, by 2020. Savvy retailers are creating mobile optimized shopping experiences that are able to deliver on their brand’s promises. Customers expect the same high-quality service that they get on a website, or in the store, on their mobile devices. For the digital landscape, this means that things must load quickly, have an easy-to-use interface, and evoke an emotional bond to the brand.

Community

Customers are looking for social connections while they are shopping. From peer reviews to chatting with friends on the latest styles and trends, today’s shoppers are tapping into their friends and virtual communities for help in navigating product offerings.

PricewaterhouseCoopers (PWC) polled 22,618 digital buyers ages 18 and older. Respondents had shopped online at least once in the past year. Nearly half (45%) of digital buyers worldwide said that reading reviews, comments and feedback on social media influenced their digital shopping behavior. Some 44% of respondents also said that receiving promotional offerings also influenced their shopping behavior.

At Valtech, we’re exploring innovative community technologies that can enhance these experiences. This can include things like building in-store digital experiences that connect to Facebook or a chat client to allow shoppers to get opinions from their friends and family before making purchases. These sorts of technologies are showing great promise.

Experiences not "things"

People, especially Millennials, want to buy experiences, not “things.” They want their money to be spent on a life well-lived, and digital has a big place in their lives. Digital experiences add new layers to the ways these millennials experience the retail world. Even the smallest of experiences can connect to customers on an emotional level to tell a powerful story.

Speed

Lastly, we want to touch on a very significant undercurrent of customer expectation in retail: speed. By and large, people want things NOW. Deloitte’s 2016 Holiday Survey says that customers in 2015 viewed “fast shipping” as anything within 3-4 days. In a single year, that figure dropped to within 2 days. This is how Amazon Prime is succeeding and, in turn, affecting all retailers. How do retailers compete? One suggestion is to use store design and logistics tools to turn community stores into miniature distribution centers. Combining this with courier services like Uber allows companies to compete, and beat, Amazon’s regional distribution center model.

Conclusion

Through our research, we’ve found that these are a few of the standout customer expectations in today’s retail marketplace. Some are more challenging than others, but using the right mix of digital innovation and store design to create ideal customer journeys is the way to compete in today’s retail marketplace.