For traditional exchanges and infrastructure providers, meeting today’s standards is no longer enough. True readiness means building for what’s next.

Capital markets are being digitally industrialized to be always-on, borderless and engineered for change. To lead the next market cycle, institutions must build adaptive operational cores, intelligent experience layers and governance models that move at speed without compromising trust.

The signals that matter

A variety of factors have come together to redefine what “fit for purpose” means:

Agility of regulation is a competitive advantage

New mandates, from ESG to cybersecurity reporting, demand real-time publishing, version control and multilingual transparency. The ability to move quickly is regulatory risk management.

Market data is outpacing monoliths

From complex asset classes to real-time market data, exchanges now control petabytes of structured and unstructured data. Static architecture can’t handle constantly changing pricing models, dashboards or real-time regional feeds. Cloud-native, modular systems are required to run and scale securely.

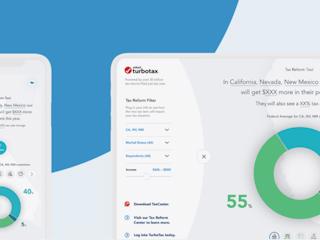

Investors expect a consumer-grade experience

Shareholders demand personalized and multilingual reporting, filing and experiences. They don’t measure your UX against your peers. They measure you against Google. Providing a cohesive experience for IR, trading, media and regulatory properties requires the shared design systems, content models and distributed authoring.

Security isn’t optional

With capital markets’ infrastructure a key target for cyberattacks, boards and regulators will want to see security embedded, not retrofitted. Secure-by-design is now a C-level discussion. Security-as-an-afterthought transformation projects receive scrutiny but will fail the instant scrutiny comes their way.

Strategic change is needed to thrive in the digital-first world

Winning the next market cycle takes much more than channel upgrades or one-off digital launches. It requires a fundamental pivot from siloed systems to cohesive digital infrastructure that makes resilience, scale and pace possible.

Three moves make up that shift:

-

Rethinking architecture. Transition from monoliths to modular systems that can seamlessly add new features and integrate small changes quickly, without having to undergo full redeployment.

-

Redefining ownership. Empower business, content and compliance teams to act autonomously, not to be bound by IT cycles.

-

Governance realignment. Ensure consistent design, language, accessibility and compliance across multi-site, multi-markets.

This is platform thinking as an engine of growth.

Making progress with speed and scale through platform thinking

Your ability to respond to regulatory changes, sentiment in the market, or an operational need should not be contingent on custom dev cycles or siloed tools. Rather, digital infrastructure today must be designed for change. It must empower you to govern, be agile and be consistent from day one:

-

Teams working in the field must have tools to manage content at velocity, in multiple languages, without sacrificing precision or compliance.

-

Investor relations, comms and product teams need to be able to work across markets from Singapore while maintaining a global standard.

-

Regulatory and legal professionals require visibility to clear approval paths and audit trails in order to satisfy the increased transparency required.

These capabilities grow prosperity. They allow institutions to meet increased expectations without injecting friction. They ensure that the more digitally complex a thing becomes, the greater the operational clarity it brings.

Technology modernization is just part of the challenge. Your operating model has to change with it. That’s how you move faster without losing trust.

Digital strength is a strategic asset

All sides are squeezing capital markets’ infrastructure. Fintech challengers move quickly. Regulators move faster. Stakeholders demand more.

The next generation of leaders will not just react. They’ll be ready. With modern architecture. With sturdy foundations. With operational clarity.

Valtech helps rethink what’s possible by building trusted, agile platforms that evolve with every shift — elevating every stakeholder’s experience from strategy to execution.

Discover how our Experience Elevation methodology delivers lasting value, sooner.

Want to future-proof your market infrastructure? Connect with our specialists to explore how your trading systems, data architecture, and client experience can evolve to meet the next wave of digital expectations.