NatWest chose to partner with us to revolutionize how the bank serves its banking customers — who represent 31% of the business banking customers in the UK. That revolution would start by building a brand-new app that would solidify NatWest’s position as the market leader.

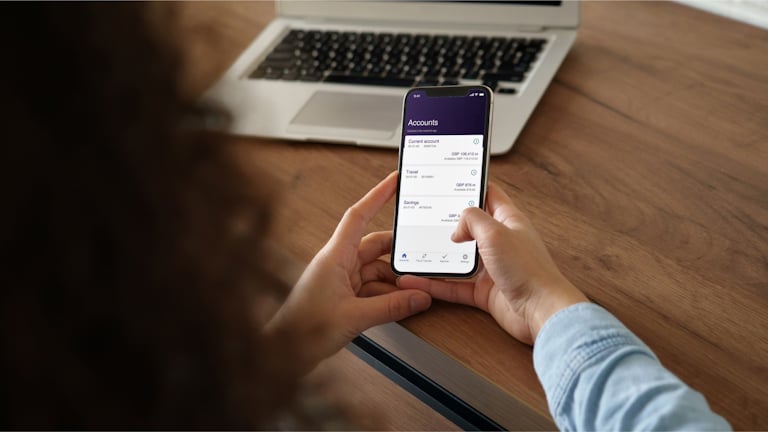

The result? Bankline Mobile: A 4.5-star-rated, highly accessible app that unified the business and delighted customers in a fiercely competitive banking environment. Its intuitive UX and UI affords users the ability to manage their accounts and transactions safely, securely and efficiently around the clock.

In addition to Bankline Mobile, we worked collaboratively to deliver change across the bank by embedding agile ways of working, uniting disciplines and eliminating waste.